View this content on Rig Zone.

by Matthew V. Veazey | Rigzone Staff | Wednesday, August 29, 2018

The Natgasoline Plant in Beaumont has successfully ramped up to full utilization.

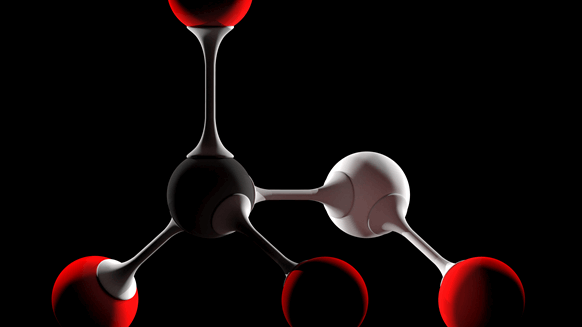

A new 5,000-metric ton per day (1.8 million metric tons per annum [mtpa]) methanol plant in Beaumont, Texas, has successfully ramped up to full utilization and achieved provisional acceptance, global methanol producer Consolidated Energy Ltd. (CEL) reported Wednesday.

“The successful completion of these critical performance tests and provisional acceptance mark an important operational milestone for the Natgasoline Plant,” said David Cassidy, chairman of CEL and Natgasoline and chief executive of Proman Holding AG, the parent company of CEL. “This is a significant turning point, and our priority now is to ensure stable production to allow us to meet our customers’ demand for methanol.”

CEL, which owns Natgasoline on a 50/50 basis with OCI N.V., noted the facility passed critical licensor performance tests in early August and has since run consistently above nameplate capacity. In addition, the company stated that the methanol plant – reportedly the largest in the United States and the only new capacity expected to go online in the Americas in 2018 – was mechanically completed in April of this year and began production in late June.

“The speed with which the facility reached full utilization shortly after initial start-up is impressive and I would like to thank all those involved for their invaluable contribution,” stated Nassef Sawiris, CEO of OCI, which along with CEL is engaged in marketing and distributing Natgasoline’s product. “The successful ramp-up of production at Natgasoline marks the culmination of OCI’s greenfield capacity expansion.”

According to a 2017 study commissioned by the Methanol Institute (MI), the U.S. methanol industry should create approximately 2,700 direct jobs paying an average annual salary of $72,500 by 2020. During the same period, the sector should generate roughly 19,000 construction jobs and nearly 3,000 indirect jobs, the report concludes. Moreover, MI noted in a recent newsletter that a “typical” 1.5-mtpa U.S. methanol plant leads to $1.1 billion in capital spending and an additional economic “ripple effect” worth $1.5 billion.

“North America is oversupplied in natural gas thanks to shale, and methanol is a great way to monetize that resource,” Uday Turago, founder and CEO of study author ADI Analytics noted at a June 2017 MI event. “Methanol also has a wide range of applications, from a chemical feedstock to a transportation fuel, and can enable to U.S. to leverage its shale gas resource to expand trade, jobs, tax revenue and other economic and employment benefits.”