Wed 19 Apr 2017 by Zubair Adam

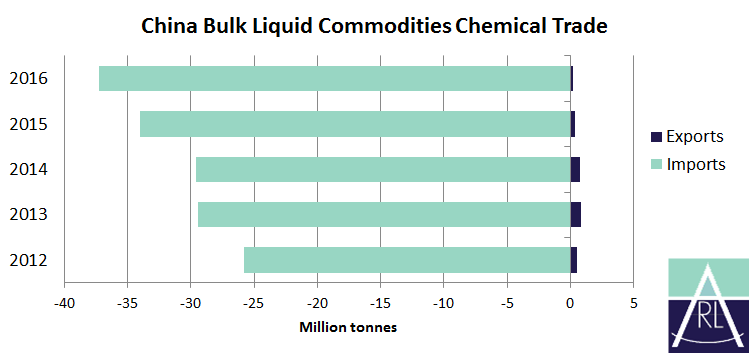

An annual comparison of total China commodity chemicals imports shows an increase of 9 per cent to 37 million tonnes; the main driver for this is methanol imports which rose by just over 3.2 million tonnes. Shipments from New Zealand and Trinidad and Tobago rose significantly, by 1.1 million tonnes and 544,000 tonnes respectively. For the latter, this is quite a significant growth as a total of only 233 tonnes were imported from Trinidad and Tobago in 2015. While remaining relatively small, exports of methanol from the USA to China rose from just 1,000 tonnes in 2015 to around 262,000 tonnes last year.

This is because the US reduced its methanol imports by 857,000 tonnes from Trinidad and Tobago in 2016, making the Caribbean islands look for different destinations for their exports. Iran remains the largest supplier of methanol to China accounting for 30 per cent and increasing its shipments from 2.4 million tonnes in 2015 to nearly 2.7 million tonnes last year. Methanol imports into China have grown due to the increased demand from new methanol to olefins (MTO) and methanol to propylene (MTP) plants. In 2015, the Chinese MTO and MTP capacity increased by 21 per cent to over 8.5 million tpa and this is expected to increase further by more than 3.6 million tpa over the next few years. This has also been the main factor for the rise in methanol projects in the USA and Middle East, from which further increases in exports are expected. Among the other products, the next two sizeable increases between 2015 and 2016 were for paraxylene and benzene by 674,000 tonnes and 344,000 tonnes respectively.

Among the major significant reductions, ethylene glycol imports declined the most by over 1.2 million tonnes, in part due to new plant coming on stream. There were lower volumes coming from the Middle East and Asia with supplies dropping by 701,000 tonnes and 637,000 tonnes respectively. Volumes from Saudi Arabia dropped the most, by 533,000 tonnes, but despite this decline, it remains the largest supplier of ethylene glycol, accounting for 46 per cent of total imports last year. A new pattern was observed in ethylene glycol supplies from North America, with a decline in shipments of 87,000 tonnes from the USA being more than offset by a rise from Canada of 223,000 tonnes. Styrene imports also declined considerably by 246,000 tonnes, the majority of which was down to lower volumes coming from Japan. There were also lower volumes of cargoes for acrylonitrile and other xylenes but the declines were comparatively of a smaller scale.

An annual comparison of total China commodity chemicals exports in 2016 shows a decrease of 218,000 tonnes (44 per cent). Methanol exports dropped the highest, decreasing by 129,000 tonnes to 33,000 tonnes last year, followed by paraxylene and benzene slowing down by 63,000 tonnes and 40,000 tonnes respectively. MTBE and ethanol volumes were marginally up, with the remaining products either having no change or declining marginally.

To summarise the changes to trade in 2016, total Chinese exports of commodity chemicals decreased by 44 per cent from 2015, while China’s imports of commodity chemicals increased by 9 per cent.

The above is from the Chemical Carrier World service provided by Richardson Lawrie Associates Ltd (RLA), a firm of international maritime economists and business consultants. More information can be found at www.richardsonlawrie.com.