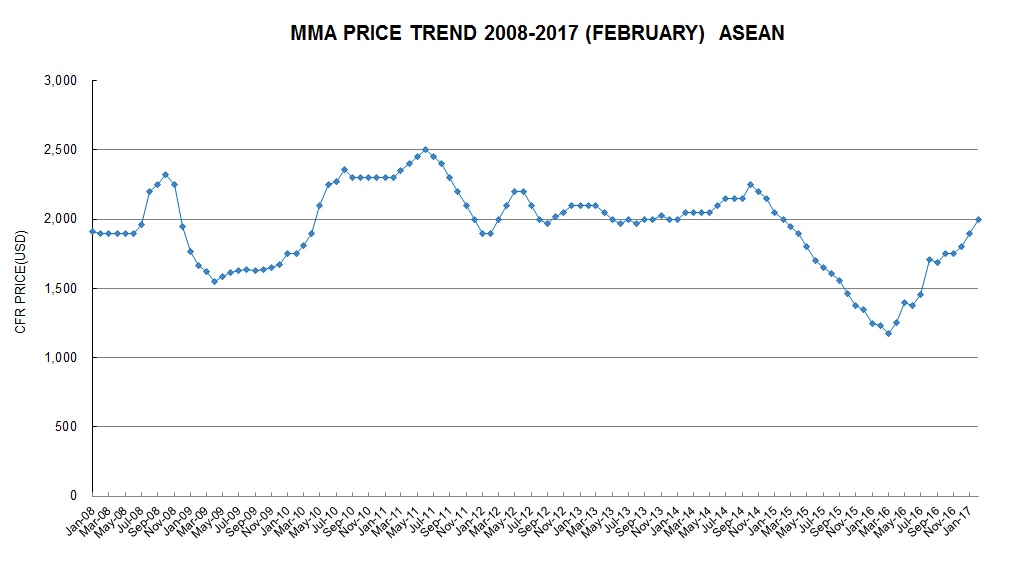

In March, MMA Asia prices continue moving upward by $100~150 pmt and supply under allocated basis to reflect tight MMA supply. MMA producers depleted inventory on the back of several MMA plants scheduled shut down for maintenance and unexpected outage during January to March. The rising feedstock costs made MMA producers suffered higher raw material costs and keen to reflect incremental cost down to customers. On the feedstock side, MMA suppliers insisted to raise MMA prices to reflect supply shortage and increasing raw material costs. MMA feedstock prices for naphtha stabled at US$510~520 pmt after Chinese Lunar New Year holiday, but acetone continued increasing to US$900~950 pmt. Methanol was slightly increasing to US$360~380 pmt and MTBE stabled at US$660~700 pmt. The price of Propylene continued increasing US$100 pmt and the prices were over US$1,000 pmt. On the downstream side, demand is sluggish across all market segments, which dampened by slow business activities on the downstream cast sheet and resin customers. However, Polymethyl methacrylate (PMMA) demand from the genera-purpose (GP) and light guide panels (LGP) grade, transparent ABS and artificial marble became health and most of them kept full operating and boosted MMA offtake recently. For the reason, most customers understood the tight MMA supply pressure and accepted MMA prices hiking, and MMA offtake does not show any slowdown. In Europe, less deep sea cargo arrived Asia recently to release the tight MMA situation because MMA supply and demand remains balance to tight. In America, tight MMA supply didn’t release on the back that MMA upstream INEOS Nitriles 545kpta acrylonitrile plant in Green Lake, Texas, USA can’t run in full after long-term shutdown, causing MMA plants kept low production rate on the back of limited HCN supply. Furthermore, a major MMA producer’s unexpected outage in January made the MMA demand surging in Asia and dampened MMA prices from February. In addition, it’s heard that Sumitomo Chemical C4-MTBE process 90kpta MMA plant in Saudi Arabia will delay to end 2017, and Mitsubishi Rayon α process 250kpta MMA plant at Al Jubail in Saudi Arabia will commission around September 2017. MMA prices for 500 mt above isotank order were settled in the ranges of $2,050 ~ $2,150 pmt CFR. The outlook of April MMA prices is still optimistic to be roll over or slightly firm.

NORTH ASIA

In North Asia, uptrend of China domestic MMA prices continued after Lunar Chinese New Year, against the backdrop of limited MMA supply, which is owing to some MMA plants’ shutdown and a major MMA plant outage in Jiangsu area. MMA prices were stable-to-firm and hovered around RMB18,000-19,000/mt DEL. In Korea, domestic market demand remains healthy, however, the MMA prices were boosted with tight MMA supply to Korean Won 2,400-2,450/kg DEL. The MMA supply shrunk because majority of MMA plants scheduled shut down and surged PMMA and artificial marble demand in Q1 2017. In Japan, MMA supply tightened on the back of limited supply availability, amid several MMA plants’ turnaround plan and unexpected outage in January and February. MMA prices stabled at JPY 240~250/kg for regular customer and at JPY 280~290/kg for spot customer. In Taiwan, domestic market remained lacklustre but the tight MMA supply made the price increasing NT$1~2/kg. FPC will restart its 98kpta MMA plant in Mailiao Yunlin early March after 4 weeks shut down for maintenance. Prevailing MMA prices were NT$64 ~ NT$67/kg DDP (US$1,950 ~$1,990 pmt).

In summary, the shoot-up of MMA prices would eventually lift up downstream polymethyl methacrylate.

However, downstream PMMA makers are suffering from the slim margins because the increment raw material costs are difficult to reflect to customer. Downstream polymethyl methacrylate (PMMA) were in in the range of $2,150-2,250/mt CFR.

SOUTH ASIA

In South East Asia, cast sheet customers are under extreme pressure on the back of shrunk domestic market demand and MMA costs. Cast sheet makers complained that increasing MMA cost can’t reflect to customer, however tight MMA supply impelled them to accept the price increase, as it’s estimated that MMA prices will not go down in the coming month. In Indonesia, domestic and export demand is steady. In Vietnam, market demand is soft and cast sheet makers complained the jump-up of MMA cost can’t reflect to customer. In Thailand, due to the political turmoil, market is very pressed and sheet producers are suffering by the shrunk demand. In India, domestic demand appears stronger because of tight MMA supply. MMA prices increased US$200~300/mt and settled at US$2,400 ~ $2,500 pmt CFR in isotank.

On the acrylic sheet side, the cast sheet prices were range at US$3.1~3.2/kg CFR Asia.