View this content on Seeking Alpha.

Nov. 27, 2018 5:47 AM ET | By Gregor Spilker

The methanol industry is in an exciting phase of growth – U.S. production capacity is expanding rapidly, and global demand is set to increase over the coming years. With various uses across petrochemicals and energy markets, methanol economics are complex. Demand for methanol is influenced by many factors; and it competes against other feedstock for olefins production, as a maritime fuel, for blending in biofuels, etc.

The methanol industry is in an exciting phase of growth – U.S. production capacity is expanding rapidly, and global demand is set to increase over the coming years. With various uses across petrochemicals and energy markets, methanol economics are complex. Demand for methanol is influenced by many factors; and it competes against other feedstock for olefins production, as a maritime fuel, for blending in biofuels, etc.

CME Group will support the market with the launch of financial contracts. European Methanol futures are already trading on NYMEX, and the exchange is now introducing an FOB Houston contract for the U.S. markets*.

U.S. Revival

In the U.S. markets, the strong growth rate in installed capacity has been driven by U.S. shale. Changing economics in methanol production are transforming the U.S. industry from a small producer requiring imports to meet demand, to a major exporter and supplier to the global marketplace.

Most chemical and refining processes use natural gas as a fuel. It is also the feedstock of choice in many applications that contribute to a $500 billion-a-year U.S. chemicals industry. By creating new industries, and stimulating old, shale gas moves investment decisions forward, restarts shuttered capacity and is underwriting a revival in many downstream markets. U.S. methanol production is one such revival story.

Until recently, the U.S. was mostly dependent on imports to meet domestic methanol demand. Trinidad and Tobago, one of the largest methanol producers in the world, matched residual demand in excess of locally produced methanol. Prior to the shale revolution, rising natural gas prices pushed chemical production outside of the U.S., where products like methanol, ammonia and others moved to locations with stranded gas resources1.

According to industry, feedstock costs represent nearly 90% of the cash costs in methanol production. Natural gas is the primary feedstock in 55% of installed global capacity – and the near totality of U.S. capacity2. When the shale revolution triggered a decline in natural gas prices and the anticipation of abundant supply for years to come, the methanol industry restarted mothballed plants – a process that began around 2011.

Chart 1. Industrial Gas Consumption & Henry Hub Price3

Propelled by persistently low natural gas prices, U.S. capacity continues to expand with recent additions, moving away from restarts to new greenfield production facilities. Beaumont, TX, is home to a 1.8M MT mega-facility that began operations in June 2018, with additional projects slated for 2019 and beyond. According to the Methanol Institute, an international industry organization, installed capacity may reach 15.6M MT by 2019, a more than threefold increase since 20154.

Low feedstock prices were necessary, but not enough on their own, for this industrial revival. Investors in methanol plants also needed to make sure that the domestic and global markets were ready to welcome the additional production output. Luckily, the demand outlook for methanol is positive.

Global Demand

Demand is currently well balanced between “traditional” petrochemical applications, such as the production of formaldehyde, acetic acid, solvents, etc., and energy demand, such as DME (dimethyl ether) and direct gasoline blending. The center of gravity of global methanol demand is steadily moving toward Asia, with China and – to a lesser extent – India taking a lead role. The most transformational change has been the emergence of Chinese MTO (methanol-to-olefins) demand – this end use has seen extremely high growth rates and is expected to represent 19.3% of global demand by 2021, according to IHS Markit5.

MTO demand is a function of prices for substitute feedstock for olefins, such as natural gas liquids. Normally, higher prices of propane or naphtha should improve MTO production economics. Beyond economics, the enthusiasm for MTO – and for CTO (coal-to-olefins)6– in China has a political and environmental dimension. Coal forms the main feedstock for Chinese methanol.

The government needs to reduce local pollution from coal-fired power plants yet protect the coal industry. CTO plants serve to protect coal demand and can be located further inland, away from the coastal mega cities. MTO plants are distributed across China, with coastal MTO plants relying on international markets for access to feedstock.

Methanol is well placed to benefit from significant changes in the global energy landscape – notably the introduction of 0.5% sulphur limits in the maritime fuel markets imposed by the International Maritime Organization. Methanol does not contain sulphur, and emissions of nitrogen oxides are much lower than oil-based fuels. Research shows that in order to generate significant environmental benefits, methanol used in shipping should be generated from biomass and the energy required in the production process of the fuel should come from renewable sources.

It is no surprise that the keenest supporters and early adopters of the technology are found in Scandinavia and in Germany. Compared to LNG, which is commonly considered as the most promising non-oil derived maritime fuel, methanol has one considerable advantage: it stays in a liquid state at ambient temperatures and is generally easier to handle. This should simplify both the ship design (including the retrofitting of older ships) and help with fuel bunkering. Still, the LNG shipping industry is some years ahead, and many more LNG powered vessels have been built and safely operated to date.

Methanol propulsion systems will initially only be attractive in limited applications, such as ferries operating regular routes in coastal Emission Control Areas (ECAs)7. The potential in the market is huge. Should methanol propulsion systems only capture 5% of the global marine fuels market, this would amount to more than 30M MT annual methanol demand equivalent – a massive change in an industry where global demand currently sits at ~80M MT p.a.8.

The energy side of the demand picture will be further boosted should the Indian government follow through with its plans to transition to a methanol economy. It is considering a 15% methanol blending standard9 to reduce crude oil imports dependency and to lower the carbon emissions intensity of the economy.

Global Price Setting And Conclusion

The addition of capacity in the U.S. was driven by low feedstock prices, the ability to activate mothballed production and by a positive demand outlook partly driven by Chinese MTO demand.

With various uses across petrochemicals and energy markets, methanol economics are multidimensional. The global methanol price is mostly driven by the Chinese market, where marginal production costs are set by coal, which remains the local feedstock of choice due to ample local reserves. The Middle East is blessed with low feedstock costs and can act as a price taking swing supplier, shifting material to the regions that offers the highest netback price.

Historically, the U.S. was a net importer, and the delivered price to the U.S. was a function of the Chinese price, adjusted for freight differences and duties. With the U.S. forecast to become a net exporter as early as 201910, Gulf Coast exports may now act as a market balancer, moving product to either Asia or Europe according to price signals.

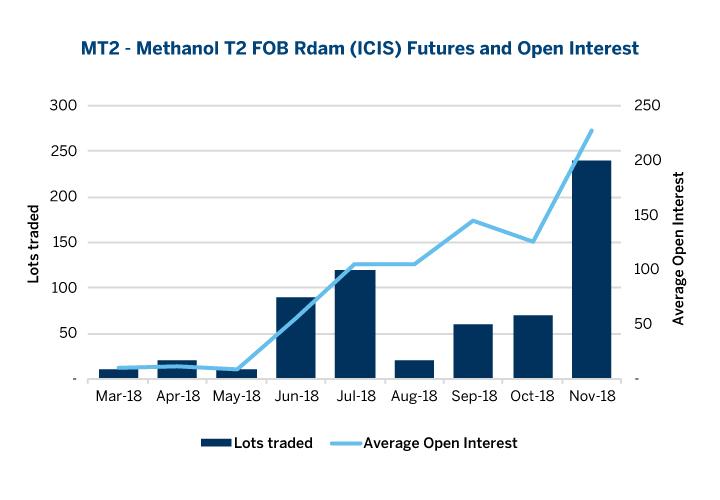

In this environment, CME Group believes that financial contracts can play an important role in helping companies hedge their commodity price risk. The exchange launched European methanol futures in early 2018 and the contracts have seen continued activity since. The continued growth in volume indicates that the European methanol industry is progressively adapting risk management tools prevalent in other energy markets.

Recent trades in October cover the entire 2019 calendar year, which could indicate that financial hedging via futures is becoming an integral part of forward planning and commodity price risk management for market participants. Physical trades based on floating, PRA indexed prices provide an alternative to the traditional contract price mechanisms; and financial contracts allow participants to fix their input or output costs against these physical transactions.

Methanol price risk can be hedged and managed on a standalone basis, or as part of a comprehensive hedging strategy that includes upstream feedstock cost hedging for producers, or downstream hedging of the final product for methanol consumers. Also, in a credit-constraint environment, exchange trading and clearing of contracts offers the benefit of removing counterparty credit risk in financial transactions.

CME Group recently announced that it was extending its product offering by listing U.S. methanol contracts (launch date December 17, subject to the CFTC regulatory approval process). The new U.S. methanol contract, in conjunction with the existing European product, offers the possibility to hedge outright price exposure in the two regions, as well as to take a position on the price difference between the two markets.

Chart 2. MT2 Volume and Open Interest

| Contract Title | Methanol T2 FOB Rdam (ICIS) Futures | Methanol FOB Houston (Argus) Futures |

|---|---|---|

| Commodity Code | MT2 | MTH |

| Rulebook Chapter | 986 | 985 |

| Listing Schedule | Monthly contracts listed for the current year and the next calendar year. Add monthly contracts for a new calendar year following the termination of trading in the December contract of the current year. | |

| Settlement Type | Financial | |

| Contract Size | 100 MT | 42,000 U.S. gallons |

| Minimum Block Size | 5 lots = 500 MT | 5 lots = 210,000 U.S. gallons |

| Quotation | Euros and eurocents per Metric ton (EUR/MT) | U.S. cents per gallon (U.S. cents per gallon) |

| Minimum Price Increment | Quoted in multiples of €0.50 per MT (€50.00 per lot)

Daily Settlement Price fluctuation €0.50 per MT Final Settlement Price fluctuation is €0.01 per MT |

Quoted in multiples of 0.25 U.S. cents per gallon ($105 per lot)

Daily Settlement Price fluctuation 0.25 U.S. cents per gallon Final Settlement Price fluctuation 0.01 U.S. cents per gallon |

| Last Trading Day | The contract shall terminate at the close of trading on the last Friday of the contract month.

If such Friday is not an Exchange business day, the contract will terminate on the Exchange business day immediately prior. |

The contract shall terminate 5 calendar days prior to the last calendar day of the contract month.

If such day is not an Exchange business day, the contract will terminate on the Exchange business day immediately prior. |

| Contract Settlement | The Floating Price for each contract month is equal to the arithmetic average of the mid-points of the week’s “Spot range assessment” for the Methanol Spot Price (FOB RDAM T2 in EUR/MT) in all weekly ICIS Europe methanol reports published during the contract month. | The Floating Price for each contract month is equal to the arithmetic average of all index assessments (fob Houston barge) for the Contract Month published in the Argus Methanol Daily report during the Settlement Period for that contract month.

The Settlement Period for a specified contract month shall be the one-month period that starts on, and includes, the calendar day that is 5 calendar days prior to the first calendar day in the contract month, and ends on, and includes, the calendar day that is 6 calendar days prior to the first calendar day of the calendar month following the Contract month. |

| PRA reference Price | ICIS, Methanol FOB R’dam T2 Spot | Argus, Methanol daily fob Houston barge index |

References

- Natural Gas as a Chemical Industry Fuel and Feedstock: Past, Present, Future (and Far Future)

- IHS Chemical: Methanol-to-olefins drives methanol demand worldwide

- New methanol and fertilizer plants to increase already-growing industrial natural gas use

- Economic and Employment Impacts of U.S. Methanol Industry

- Methanol Industry Overview

- CTO plants are essentially MTO plants that are integrated further upstream: CTO plants consume coal to produce olefins, and methanol forms part of that chemical manufacturing process. MTO plants require methanol as a feedstock.

- Study on the use of ethyl and methyl alcohol as alternative fuels.pdf

- Methanex Investor Presentation

- “Methanol Economy”: NITI Aayog working on road map for India On World Environment Day, 2018

- Texas methanol start-up marks beginning of new era in US