View this content on Bloomberg.com.

By Alex Longley and Irene Garcia Perez | August 30, 2018, 6:24 AM CDT

-

IMO 2020 changes to lift price of lower-sulfur crude: survey

-

Regulations will limit the amount of pollution ships can emit

The Soro Enshi container ship, operated by A.P. Moller-Maersk A/S, sails from Yangshan Deep Water Port in this aerial photograph taken in Shanghai, China. Photographer: Qilai Shen/Bloomberg

New regulations to curb pollution from the world’s shipping fleet could lift crude prices by $4 a barrel when the measures come into effect in 2020, according to a Bloomberg survey of 13 oil industry analysts.

That’s because the changes from the International Maritime Organization, a United Nations agency, are likely to stoke refiners’ demand for lower-sulfur crude while prompting some plants to run as hard as possible to maximize profits.

“It will be a Wild West leading up to the implementation phase,” said Michael Poulsen, an analyst at A/S Global Risk Management Ltd. in Denmark. “The market anticipates that we will see a lot of weird movements and funny pricing around the end of 2019.”

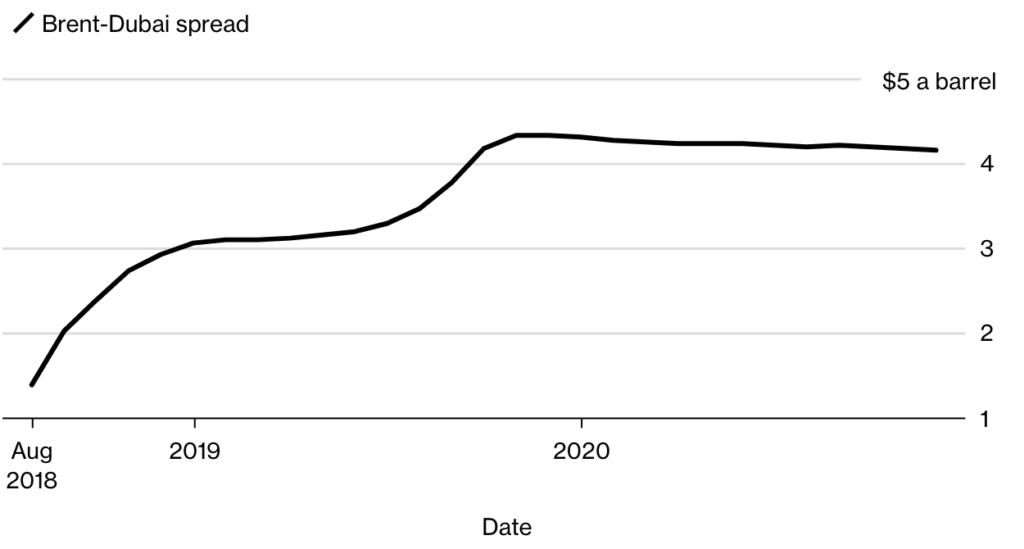

Brent Boost

Global benchmark set to gain from IMO 2020 rules

Source: Bloomberg

Source: Bloomberg

In just 16 months, the IMO’s rules to cap the sulfur content of ship fuel are set to create a once-in-a-generation upheaval in the oil market, as the regulator seeks to limit emissions of a pollutant that has been linked to asthma and acid rain. The global shipping fleet is reliant on refiners to supply IMO-compliant fuels, and it’s not clear there will be enough to go around. Prices for low-sulfur products are already climbing, while those for high-sulfur grades are collapsing.

A similar effect is expected in the crude markets. Banks including Societe Generale SA and Morgan Stanley have said the regulations will likely lift crude benchmarks Brent and West Texas Intermediate, which have a relatively low sulfur content. Brent’s premium to higher-sulfur Dubai crude, the Middle East benchmark, has already swelled to more than $4 a barrel in 2020.

$128 Billion

Bloomberg asked analysts to estimate the likely price effects of the regulatory change. Crude prices are forecast to rise by $4 a barrel in 2020 due to the IMO rules specifically, according to the median estimate of 13 responses that ranged from a $2 drop to a $20 increase per barrel.

“Of our $90 a barrel Brent price forecast by early 2020, we’d argue that $5-$10 a barrel will come from IMO 2020,” said Morgan Stanley analyst Martijn Rats. The shift in demand to less-polluting oil products will mean that “without investing in more upgrading units, refiners will simply need to process more crude,” he said.

By 2020, global crude oil demand is set to rise by 2 percent to 87.7 million barrels a day, according to a forecast from the Paris-based International Energy Agency in March. If crude prices surge by $4 a barrel due to the IMO rules, that would amount to an increase of about $128 billion in the world’s oil bill by 2020, Bloomberg calculations show. Brent crude, the global benchmark, is now trading near $77.50 a barrel.

Ship Scrubbers

While the majority of those surveyed agreed the rules will probably have a bullish effect on crude, some were more reticent. That’s because ships have the option of installing so-called scrubbers allowing them to keep burning high-sulfur fuels while limiting emissions of the pollutant.

“More and more ships will install scrubbers and therefore reduce the demand for extra barrels,” said HSH Nordbank AG analyst Jan Edelmann, who saw no impact on crude prices from the regulations. “We believe that there is sufficient light-sweet crude available from shale to meet extra demand from IMO 2020.”

Companies that make scrubbers, including Wartsila Oyj and Alfa Laval AB, reported bumper orders in their most recent earnings. However, the vast majority of the world’s commercial fleet — some 93,000 vessels — will not have installed scrubbers, which can cost millions of dollars, by 2020.

Also see: Maersk Sees Fuel Bill Soaring by $2 Billion From 2020 Rules

The IMO’s regulations are likely to ripple through industries that purchase fuel, such as airlines and power producers. Because of this broad reach, some analysts contacted by Bloomberg said they couldn’t yet forecast crude prices for 2020 or the effect of the IMO rule change specifically.

Gasoil Boom

The brunt of the regulatory shift is likely to be felt in refined-product markets, as shippers abandon high-sulfur fuel oil in favor of cleaner alternatives, like gasoil or diesel-like fuel that can be blended into IMO-compliant ship propellant. Benchmark gasoil prices in Europe are set to rise by about $17 a barrel by 2020, according to the median estimate from nine analysts who provided figures on the fuel.

The strength in oil product prices may help to lift crude, too. Nine of 13 respondents said the IMO regulations will be positive for refining margins. Rising profits would encourage refineries to boost crude purchases, potentially lifting the feedstock’s price.

“We believe the extraordinary strength in distillate cracks will cause refiners to run as hard as they can,” Societe Generale SA analysts including Mark Keenan wrote in a report earlier this month. “This very strong crude demand will add $5 to sweet crude prices.”