19 April 2018 14:30 Source: >ICIS News

LONDON (ICIS)–China continues to be the key market for methanol producers, but India is growing in prominence as a consumer, according to the managing director of producer IGP Methanol.

LONDON (ICIS)–China continues to be the key market for methanol producers, but India is growing in prominence as a consumer, according to the managing director of producer IGP Methanol.

“Not all the demand is coming out of China, but a lot of it is really pent-up demand,” said IGP managing director James Lamoureaux.

IGP is currently developing a new methanol production complex in Myrtle Grove, Louisiana, US, that stands to be the world’s largest.

To be made up of four identical trains with capacities of 1.8m tonnes/year apiece for a total of 7.2m tonnes/year, the installation is set to capitalise on cheap raw materials costs on the US Gulf coast and increasing demand for methanol as a clean fuel in the developing world.

The project was first announced in January this year and a flurry of announcements have followed since then, including a memorandum of understanding to ship up to half the complex’s anticipated product to a methanol to olefins (MTO) unit under development in China’s industrial port of Jinzhou.

Despite the suddenness of the project’s arrival, work has been going on behind the scenes for some time, according to Lamoureux.

“We have been operating in complete stealth mode for a number of different reasons, and one of the biggest is complexity of permitting in the US,” he said.

“We don’t see ourselves as a merchant methanol player, we’re looking to vertically integrate that supply chain with new demand. Our company is what I would consider a late-stage start-up company, we are positioned as a developer and infrastructure company,” he added.

CHALLENGING US DEVELOPMENT

IGP’s project is not the first US methanol complex with a headline-grabbing capacity to appear on the landscape, and others, by Northwest Innovation and Fund Connell, seem to have run aground for the time being.

Fund Connell planned a 7.2m tonne/year complex manufacturing product aimed at China, but no updates have been heard for some time, while Northwest asked authorities in Tacoma, northwest US, to pause the environmental review process for its complex in 2016 under pressure from community opposition.

The issues experienced by those projects have been in part due to the complexities of new players getting projects approved in the US and maintaining momentum in the face of potential opposition, according to Lamoureaux.

“[Those projects] were announced, people thought they were coming, but US development is challenging from a permitting risk perspective and doing business in the US can be more complex that it appears,” he said.

“The fact is that, in the US, it is difficult to negotiate all of the different interest groups, so we have tried to do a good job of getting the local community involved and we went above and beyond on our front-end engineering to really use best-in-class tech in every situation to drive down emissions, and then control the narrative,” he added.

According to Lamoureaux, the company differentiates itself by giving greater weight to the barriers that can be thrown up in the permitting phase, as well as lining the company’s management board with veterans who have experience in that area.

These include CTO Randall Harris, a former senior engineer for the US Department of Energy and project director Keith Vidalin, who helped to oversee the development of Methanex’ 2m tonne/year Geismar methanol plant in Louisiana.

DEVELOPMENT MILESTONES

However, IGP needs to raise and close financing for the project, and are about to add a new team member who specialises in raising project financing.

The company has signed up engineering firms CB&I and Haldor Topsoe for preliminary design and technology work, while the US-based firm has also been tasked with developing a binding lump sum for the complex.

A gas offtake supply agreement has been agreed with Conoco, but this ratchet up as supply is needed.

“[The Conoco contracts] are hard agreements, but they are condition-precedent agreements that call for an increase as the offtakers come on, then have time horizons, modelled after the way the successful LNG guys were able to do their project,” Lamoureaux said.

EXPORT DESTINATIONS

Cheap feedstocks and the scale of the plant are expected to place the complex in the top quartile of cost competitiveness for methanol producers worldwide, but the same question mark hangs over the project as over a lot of new US petrochemicals capacity at present – where the material will go.

Domestic demand is balanced, and Europe is not expected to soak up material to an extent that a plant at the scale of the IGP project will produce.

“We’re advantaged from a sailing time to Europe over Asia, but Europe cannot take the size cargoes that Asia can,” Lamoureaux said. “There are ports from Singapore up to Korea and China that can take 100,000-120,000 tonne ships.”

India is also increasing focus on methanol for its energy needs, Lamoureaux said, adding that it remains to be seen how that demand will affect global trade flows.

“India is also coming on fast with their vision of the methanol economy, you can’t build all that out of coal. As they drive their methanol business we’re already seeing enquiries from India, and where that supply is going to come from and whether that is going to disrupt some of the flow out of Iran and the Middle East,” he said.

But China, focused on improving air purity in its cities, remains the key destination for global methanol, according to market players.

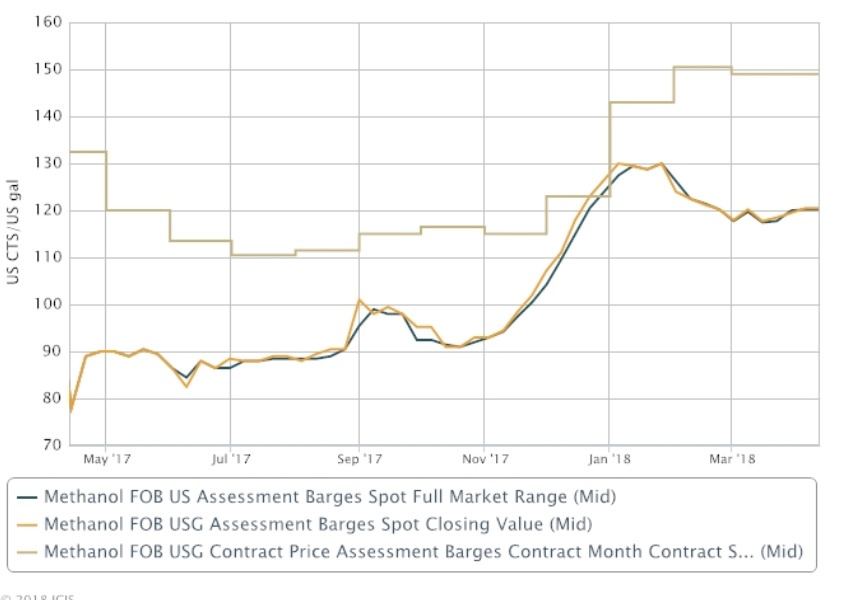

Earlier this year, Methanol Market Services managing director Mark Berggren hailed a sea-change in the fortunes of US methanol producers, based on low feedstock costs, firmer spot and contract prices, and the strength of Chinese demand, which he called ‘the only game in town’ for US players.

“Most of the demand growth is in China, and most of it is in MTO demand,” Berggren said, speaking at the IMPCA Mississippi Conference America in February.

IGP has connections to China, successfully forming a joint venture in 2012 with local player Yankuang Group to build a series of coal to isobutanol plants in the country.

Issues of commercialisation of the technology led to those plans being shelved, but Lamoureaux has retained links with players in the country, resulting in the supply agreement with logistics firm COSCO and a subsidiary Jinzhou Port Co Ltd for the planned 600,000 tonne/year methanol plant.

METHANOL IN CHINA

The MTO sector has experienced a rocky period of growth in China, with volatile pricing impacting on the competitiveness of plants in the country. However, the current administration has taken a more-focused approach to permitting new plants, according to Lamoureaux.

“The Chinese government in the past has allowed irrational exuberance in allowing many things to be built and then crashing the market. President Xi [Jinping] has instilled controlled discipline in growth,” he said.

Questions of economics remain for China MTO plants, particularly for facilities that rely on imported feedstocks.

With the standard ratio at the units standing at three tonnes of methanol to produce one tonne of olefins, and US methanol spot pricing standing at 118 cents/gallon (around $393/tonne) in April, current prices for US material would stand at around $1,179/tonne per tonne of ethylene, without incorporating transportation costs.

April Asia Pacific ethylene pricing stood at $1,340-1,360 CFR (cost and freight) NE Asia, while domestic China methanol spot pricing stood at China yuan 2,850-3,030/tonne ($454-482/tonne) on an ex-tank East China domestic basis, leaving headroom for a slight MTO price advantage, but the margins remain slim.

April Asia Pacific ethylene pricing stood at $1,340-1,360 CFR (cost and freight) NE Asia, while domestic China methanol spot pricing stood at China yuan 2,850-3,030/tonne ($454-482/tonne) on an ex-tank East China domestic basis, leaving headroom for a slight MTO price advantage, but the margins remain slim.

However, technology is improving, which can make the economic case a lot stronger, as can moving further down the value chain for production, according to Lamoureaux.

“There is a second-gen MTO technology out there and CB&I/Lumis are one of the two providers that get the economics down to 2.5:1 for methanol input to olefins output. Then there’s the opportunity for MTO to go further down the value chain increasing returns,” he said.

There is also the factor of Chinese policy driving the development of the sector, with the Jin Zhou project moving forward following the closure of several heavy-polluting low-grade steel plants at the port.

The crackdown on pollution has led coal to chemical projects to lose favour with the Chinese government, and methanol offers potential as a cleaner-burning fuel for transportation and heating.

There is also talk of developing methanol storage and transportation bases across China to take in overseas methanol shipments, and stabilise pricing by establishing a methanol reserve to provide a floor on pricing and a resource for heating during high-demand months. For now, methanol has not been the focus of trade sanction threats despite growing tensions between China and the US.

“There were reports going back to the 1970s saying methanol is a perfect fuel if you can produce enough of it at a low enough price, and I think we’re at the tipping point of that now,” Lamoureaux said.

MILESTONES AHEAD

More announcements on the IGP complex are expected in coming months, with two trains of product as yet unallocated.

Under the memorandum of understanding signed by IGP, COSCO and Jin Zhou are to cooperate in developing up to two of the Louisiana plants, but Lamoureaux declined to comment on whether this would involve an equity stake in the project for the Chinese companies, except that long-term partnerships are expected to be part of the development of the complex.

“It is very Chinese to vertically integrate your supply chain… but this is on a case by case basis,” Lamoureaux said.

“We are in discussions with multiple parties, we should see announcements on that. We are looking for offtakers who want to be long-term participants, that’s part of our business model,” he added.

($1 = CNY6.28)

Pictured: Proposed location for IGP Methanol’s Myrtle Grove plant in Plaquemines, Louisiana

Source: IGP Methanol

Interview article by