SINGAPORE (ICIS)–China’s import prices for methanol crossed the $300/tonne mark this week, hitting their highest levels in more than four months, in line with gains in the futures market.

Some market players doubt the strong gains would be sustained in the near term. Prices are likely to continue to track the volatile methanol futures market, which may be due for a correction after months of steady increase.

Two spot methanol fixtures were done early this week above $300/tonne CFR (cost and freight) China – one at $301/tonne CFR China and the other at $309/tonne CFR China.

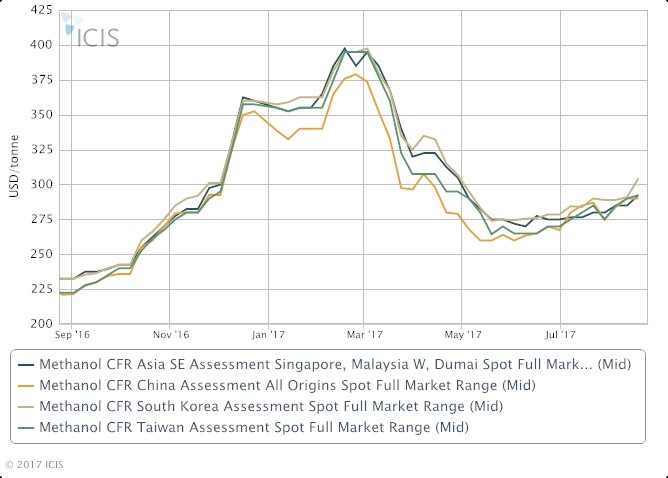

Prices have steadily increased since end-July, gaining a cumulative 5.5% to $290/tonne CFR China in the week ended 18 August, according to ICIS data.

Chinese import prices were last seen above the $300/tonne CFR China mark from December 2016 to mid-April 2017, the data showed.

Market players have a bearish outlook on the methanol market for the rest of the year, with additional domestic capacities starting up in China, and the possibility of fresh supply coming from Iran.

Kaveh Glass’ plant in Dayyer, Iran, with a methanol nameplate capacity of 7,000 tonnes/day, is due to start up in the fourth quarter.

China is Iran’s major export market for methanol.

Demand for the material in China was largely stable, but briefly softened in July and August amid a heat wave the prompted a reduction in operating rates at downstream plants.

But methanol prices in both the import and domestic markets in China have been defying expectations, continuing their uptrend, riding on strong gains in the futures market.

On 24 August, methanol futures prices at the Zhengzhou Futures Exchange closed at Chinese yuan (CNY) 2,739/tonne ($411/tonne), up CNY45/tonne from 18 August.

For the rest of Asia, spot discussions have been limited, with regional markets generally taking their cue from the Chinese market.

“Due to the lack of liquidity and limited spot discussions in South Korea this week, we can only take a price direction from the key China market,” a South Korea buyer said.

Trading was also thin in the Taiwanese market, with buyers preferring “to discuss on a formula-linked basis, as they could not give any fixed-number bids that were competitive to those heard in China”, a trader said.

In southeast Asia, on the other hand, discussions increased this week following the unexpected shutdown of PETRONAS’ 1.7m tonne/year methanol plant No 2 in Labuan, Malaysia, with most players have taken a cautious stance on the market.

Current bids are quoted at $295-300/tonne CFR SE Asia, up by $5/tonne from the previous week.

“Prices should go up further next week if PETRONAS’ plant remained shut. But for now, there is no significant impact on market fundamentals yet,” a buyer said.

Market fundamentals in this region is “quite balanced, so southeast Asia prices should not firm up too much on the basis of the Chinese futures market,” said a regional trader.

Focus article by Kite Chong

($1 = CNY6.66)

Pictured above: Plywood beams. Methanol is used in the production of formaldehyde, acetic acid and other chemical intermediates, which in turn are used in the manufacture of a wide range of products including plywood, particleboard, foams, resins and plastics. (Source: Mito Images/REX/Shutterstock)

By