By Peter Neil | Mar 27, 2017 8:49 am EDT

On March 20, 2017, Eastman Chemical (EMN) announced an increase in the prices of methyl acetate. The price increase of $0.150 per kilogram will be effective beginning April 1, 2017, in North America.

The price hikes were mainly driven by an increase in raw material costs. The price hike could impact EMN’s revenue positively in 2Q17 provided volumes don’t fall. However, since the price rise was a result of higher raw material prices, we could see an increase in the cost of goods sold as well.

Eastman Chemical’s stock price

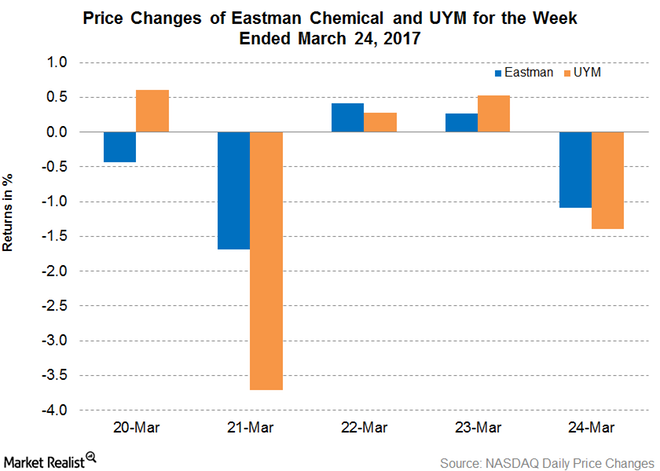

For the week ended March 24, 2017, EMN closed at $77.18, a 2.5% fall for the week. EMN’s stock price traded marginally above the 100-day moving average price of $77.00. If the stock continues its downward trend, we could see a 100-day moving average trend reversal. On a year-to-date basis, EMN has moved up 2.6%. EMN’s 14-day relative strength index (or RSI) of 41 indicates that the stock is neither overbought nor oversold. An RSI of 70 indicates that the stock is overbought, and a score of 30 suggests that the stock is oversold. EMN’s 52-week low is $62.70, and its 52-week high is $82.10.

EMN outperformed the ProShares Ultra Basic Materials ETF (UYM), which fell 3.7% for the week ended March 24, 2017. UYM invests 1.4% of its portfolio in Eastman Chemical. The top holdings of the fund include Dow Chemical (DOW), DuPont (DD), and Monsanto (MON), which have weights of 8.8%, 8.5%, and 6.1%, respectively, as of March 24, 2017.