26 March 2017 21:00 Source: ICIS News

By Nigel Davis

SAN ANTONIO, Texas (ICIS)–This is a landmark year for the US petrochemical industry. The tension that has built as companies have moved smartly to take advantage of ethane and NGLs abundance will be released. The polyethylene genie will be let out of the bottle.

Producers will manage a period of adjustment as new plants are brought up to capacity, shipping, storage and supply chains are tested, and markets massaged to absorb new volumes of polyethylene and other ethylene derivatives.

It is the timing of the start-ups, the speed of capacity build-up and the balance of the product mix that will be all-important. Ethylene and ethylene derivatives producers in the US have enjoyed an extended period of strong margins. Intriguingly in recent weeks, US naphtha cracker margins have been stronger than those based on ethane feed because of high prices for cracker co-products like propylene and butadiene.

But the real story is about ethane-based cracker margins, ethylene margins, in other words, and, more accurately, integrated polyethylene margins and those for other ethylene derivatives.

Global ethylene demand growth remains healthy despite the slowdown of China’s previously rapid economic expansion. The US and Europe seem to be pulling more strongly out of the mire. There are pockets of growth or, rather, an underlying base of demand growth that will help ease the new capacities onto the global market.

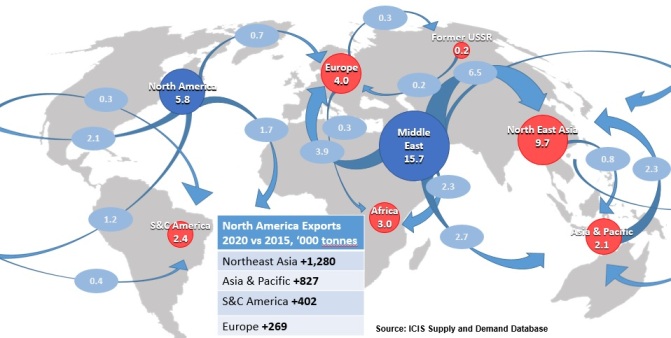

But there is bound to be a period of reduced margins. Dire warnings of the impact of new PE volumes have been knocked aside by the big producers. They have had plenty of time to develop and prepare markets, some far flung. It is likely that, proportionately, most polymer will be exported to Latin America and Asia. Fewer tonnes will be placed in Europe and Africa – there are real opportunities for greater market development in Africa – and in the US.

Potentially, US ethylene capacity will rise by 5.4m tonnes this year as four new crackers and a re-start are brought on-line. The ethylene will be used to make PE, polyvinyl chloride (PVC) and monoethylene glycol (MEG).

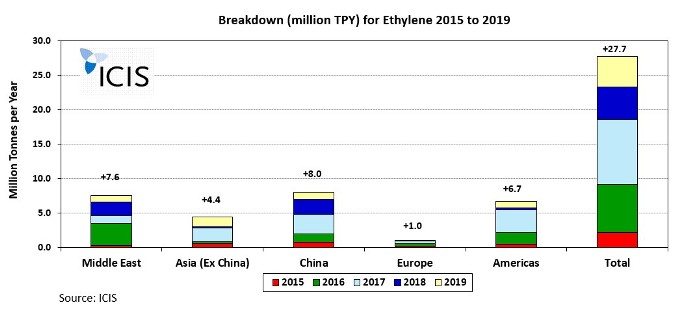

The big cracker operators, those with assets in the US, Europe and some in Asia, look at, and speak publicly about, the global picture. So balancing ethylene supply and demand is a consequence of regional growth in the Americas, Europe, Asia and the smaller consuming regions. It is also reliant on the capacities due on stream this year in the Middle East, wider Asia and in China.

This is where growth of and production from methanol to olefins (MTO) plants in China become so important. Currently, ethylene prices worldwide are set by the break-even point of the marginal Asian naphtha cracker. At some time in the future, however, high cost MTO producers in China might, theoretically, be setting the global ethylene price floor. Initially, however – over the next two or more years – there will be so much new additional ethylene capacity in the US that these theoretical pricing mechanisms could well be disrupted.

Canada’s NOVA Chemicals has already brought new PE capacity on-stream based ultimately on US shale.

Speaking ahead of the 2017 AFPM IPC, Naushad Jamani, who is the company’s senior vice president responsible for olefins and feedstocks, pointed out the significant differences currently between the rate of ethylene capacity growth in the US and that in other parts of the world.

“We expect North American producers to continue to be cost-competitive globally and have opportunities to export products once the domestic demand is met,” he said. “The good news is that global capacity growth is not out of line with global demand growth – the world needs this new product.”

Global PE product flows

It is clear that managing the inevitable disruption from the new capacities will be key. Ethylene producers in North America will balance at the margin, for instance, their output of ethylene destined for PE and for the production of other derivatives. But they will be looking at the global picture.

“[We] will be thinking about the entire globe as our market rather than the traditional markets we have served,” Jamani added.

“Cycles appear to be very different now than over the past 30 years I have had in the industry – it is much more global and time will tell where the market is going.”

Hosted by the American Fuel & Petrochemical Manufacturers (AFPM), the IPC continues through Tuesday.

Additional reporting by Simon West