Tue 21 Mar 2017 by Zubair Adam

A year-to-date comparison of total US commodity chemicals exports up to November last year shows an increase of nearly 1.8 million tonnes (16 per cent). Exports have risen across the board apart from acrylonitrile, ethylene glycol, benzene and toluene. US commodity chemicals exports have picked up the most into South Korea, China and Brazil by 569,000 tonnes, 457,000 tonnes and 380,000 tonnes respectively. Mexico remains the main destination accounting for 22 per cent of total US commodity chemicals exports, growing by 212,000 tonnes. By contrast, shipments heading to Europe shrank by 192,000 tonnes.

The major increases in exports were for methanol, ethanol and MTBE/ETBE which increased by 672,000 tonnes, 655,000 tonnes and 453,000 tonnes respectively. Exports of methanol have grown at a faster pace to South Korea and Europe, particularly to Belgium and the Netherlands. The increases of ethanol were to Brazil, China and India respectively. The increases in MTBE/ETBE exports have been mainly to Mexico and Japan along with smaller increases to Chile, Taiwan and Malaysia. Among other commodity chemicals export gains, more styrene shipments headed to South Korea and reached 362,000 tonnes, surpassing the 2015 annual total of 136,000 tonnes.

Overall, USA imports of commodity chemicals decreased by over 1.1 million tonnes (14 per cent). All products have seen a decline in volumes apart from MTBE/ETBE and paraxylene. Methanol imports have been the main factor for the decline in total imports. The 92 per cent fall in methanol imports has been due to lower volumes coming from Trinidad and Tobago, the major supplier of methanol to the US, with November year-to-date shipments dropping from 2.1 million tonnes in 2015 to just over 1.2 million tonnes last year. There were comparatively smaller slowdowns in shipments coming from the Middle East and Asia. Contrastingly there were increases in shipments from Equatorial Guinea, Canada, and the Netherlands. Benzene imports also dropped by 345,000 tonnes with the majority of this reduction from Europe and Asian suppliers, while the most significant increase in supplies have been from South Korea which rose by 76,000 tonnes.

We envisage this trend of increase in exports to continue with import volumes being subdued. This is mainly from the rise in petrochemical projects, taking advantage of the comparatively cheaper domestic feedstock from shale gas. Methanol will be one of the major drivers for US exports mainly heading to Asia, the bulk of which being supplied to China for their rising demand from MTO (methanol to olefins) and MTP (methanol to propylene) capacity. Some upcoming US methanol projects include capacity that will be built on the west coast for the first time.

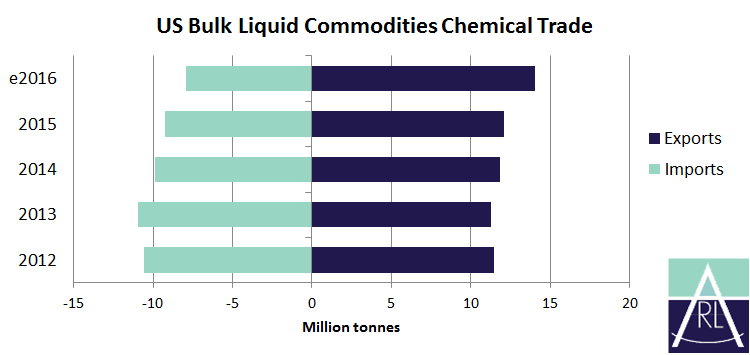

Based purely on changes in year-to-date trade figures, total US exports of commodity chemicals this year would increase by 16 per cent from 2015, while US imports of commodity chemicals would decrease by 14 per cent.

The above is from the Chemical Carrier World service provided by Richardson Lawrie Associates Ltd (RLA), a firm of international maritime economists and business consultants. More information can be found at www.richardsonlawrie.com.